Save on Your Next Bike with the New GST Rules (2025)

Share

India’s dominant two-wheeler market pretty much guarantees continual interest in bikes, scooters, mopeds, dirtbikes, etc., all year long from an evolving, informed audience.

As a result, the constant market movement results in new product launches, product variants, and constant financial schemes and incentives like leasing, loans, EMIs, etc. that cater to the broader customer base.

However, with all that being said, being a major market segment means that they also lie under the umbrella of existing government and economic policies (and are affected by it). And if you’re planning to purchase soon, or add a new one to your already existing collection (or fleet); you will have to consider taxation.

More specifically, you will have to consider the GST charges.

Even more specifically, you will have to consider the GST structure circa 2025 (the time of writing this).

Why is that? Let’s put it simply: The GST Council has completely shaken up the tax rules. Will that affect your wallet? Absolutely.

Without further ado, here’s the lowdown on everything you need to know.

What is the New GST Rate Structure for Bikes?

Let’s keep this simple.

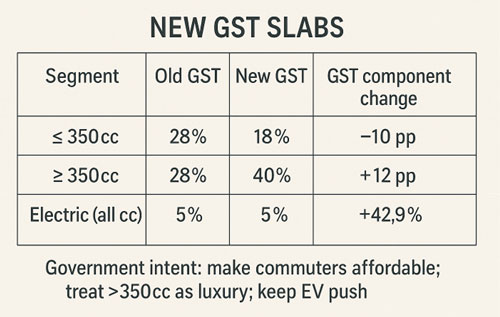

The government has basically split the bike world into two camps, when it comes to GST:

1. Bikes under 350cc:

The GST on these is dropping from a hefty 28% down to a much friendlier 18%.

2. Bikes 350cc and above:

Brace yourselves. The tax here is jumping from 28% all the way up to 40%.

Why? Well, here’s the thing: Their goal is to make biking for daily commutes a bit easier to afford for the everyday customer.

But for the high-end, powerful machines? Well, they’re now officially a luxury item with a premium tax to match. Oh, and if you’re going green, you’re in luck.

Electric bikes are staying at their super-low 5% GST rate to keep encouraging the EV shift.

What Will Be the Impact on Bike Prices?

Okay, let’s get to the part you really care about: how much more (or less!) you’ll be shelling out.

Commuter Bikes (Under 350cc):

Good news here.

You can expect prices to drop by about 8-10%. This means popular models like the Hero Splendor or Honda Shine will get a nice little price cut. We’re talking a potential saving of anywhere from ₹5,000 to ₹15,000, depending on the bike. Not bad at all.

Premium Bikes (Above 350cc):

Not-so-good news here (unfortunately). In fact, it may sting a bit.

Prices are set to climb by 10-12%. So, that Royal Enfield Classic 350+ or a KTM 390 you’ve been dreaming of? It’s going to cost more. For example, a rider in Delhi looking at a ₹3 lakh bike will suddenly see the GST jump from ₹84,000 to a whopping ₹1,20,000. That’s a serious ₹36,000 increase.

To put it simply:

- A ₹1 lakh commuter bike will have its GST cut from ₹28,000 to ₹18,000.

- A ₹3 lakh premium bike will see its GST shoot up from ₹84,000 to ₹1,20,000.

What is the Implementation Timeline?

The new GST slab was underway on September 22, 2025. Which means, we’re already under this tax slab.

Dealers have a transition period to clear out their old stock, but after that date, all new billing systems must reflect the new rates. No excuses.

Here are a few key things to remember: Any new booking made after* September 22, 2025, will be slapped with the new GST.

- Already booked your bike and paid in full? You’re safe. The old rates will be honored.

- Manufacturers will be updating their ex-showroom prices, so expect to see those change.

Honestly, the timeline is pretty clear, which is good news. It gives everyone—buyers and sellers—a chance to adjust without too much chaos.

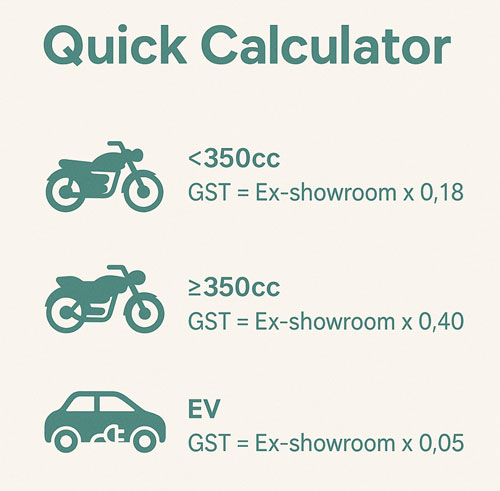

How to Calculate the GST on Bikes?

In a country like India, it always helps to have a 360-degree economic awareness of the goods and services (in this case, bikes) that you plan on purchasing.

And yes, no need to worry. You don’t have to be a maths or economic whiz to figure this out.The calculation is actually very straightforward.

- For bikes under 350cc: Just take the ex-showroom price and multiply it by 0.18. That’s your GST. Example: A bike costs ₹1,00,000 (ex-showroom) × 18% = ₹18,000 in GST.

- For bikes 350cc and above: Same deal, but multiply the ex-showroom price by 0.40. Example: A bike costs ₹3,00,000 (ex-showroom) × 40% = ₹1,20,000 in GST.

But remember, the ex-showroom price isn’t the final story. You’ve also got to factor in other costs like state registration, insurance (which is mandatory), and road tax. These vary from state to state. A pro tip from industry experts: always, always ask the dealer for a full, itemized on-road price breakdown. No surprises that way.

Special Cases and Exemptions

Now, what about the exceptions? There are always a few, right?

- Electric Bikes: As we mentioned, these are the golden child. They’re staying at a low 5% GST, and you might even get extra state subsidies. It’s a clear push to get more people to go electric.

- CKD (Completely Knocked Down) Kits: If you’re into assembling bikes, the standard GST rates will apply based on the final engine capacity. Just remember that import duties are a whole separate calculation.

- Spare Parts & Accessories: No changes here. All your after-market parts and accessories will still have the standard 18% GST.

Custom/Modified Bikes: Thinking of modifying your bike? The GST is based on the original* engine capacity from the manufacturer. So, no, you can’t tweak your engine to sneak into a lower tax bracket.

Frequently Asked Questions

1. When do the new GST rates on bikes come into effect?

The big day is September 22, 2025. From that day forward, any new bike purchase will fall under the new tax rules: 18% for bikes under 350cc and a steep 40% for those 350cc and over.

2. How will the new GST rates affect bike prices?

It’s a mixed bag! If you’re buying a commuter bike (under 350cc), you’ll save some cash—prices are expected to drop by 8-10%. But for premium bikes (350cc+), get ready to pay more, as prices will likely jump by 10-12%.

3. Are there any exemptions to the new GST rates?

Yes, absolutely. Electric bikes are the main exception. They get to keep their special 5% GST rate, which is a great incentive to go green. The new structure doesn’t change that.

4. How do I calculate the new GST on my bike purchase?

It’s pretty simple. For a bike under 350cc, just multiply the ex-showroom price by 18% (or 0.18). For a bike 350cc or over, multiply it by 40% (or 0.40). For instance, a ₹1 lakh commuter bike will have ₹18,000 in GST.

5. What happens to bookings made before September 22, 2025?

You’re in luck! If you’ve made a booking and, importantly, paid in full before the deadline, the dealer will honor the old GST rates. Any new bookings after that date will have to follow the new, updated rates.

Conclusion

So, what’s the bottom line here? This new GST structure is a game-changer for the Indian two-wheeler market. It makes everyday bikes more affordable for the masses while making high-end motorcycles a true luxury purchase.

If you’re planning to buy, take our advice: talk to your local authorized dealer.

Make sure to get a detailed on-road price, and figure out how these changes affect your budget. A little planning now can save you a lot of money and headaches later.

For more on bike prices and cost-savings; keep following Ecozaar.

Based on 1 rating

Abhishek Nair (Author)

With 8+ years of experience across manufacturing, banking, and sustainable e-commerce, he brings a sharp business lens to every conversation. An MBA with a love for football, motorsports, and all things fast—on the field or on two wheels.

Read moreRelated Blogs

Popular articles are selected based on the number of readers